What does 2020 have in store for the M&D industry?

The past year was a difficult one for the US manufacturing industry. Even still, indicators point to the likelihood of a contraction in coming years despite continued expansion of the US economy, our longest in history. Manufacturers faced a multitude of challenges in 2019, ranging from global trade disputes and tariffs to persistent difficulties with attracting and retaining skilled labor to US factories. As we enter a new decade, these issues, along with pressures to modernize, automate, and build smart factories, are daunting for small to mid-size companies across the region.

Two thousand and nineteen saw manufacturing output fall from January to June, causing a technical recession throughout the sector. While production rose from July to September, preliminary data illustrates a second decline in the fourth quarter. Many manufacturers blame the trade wars and tariffs for declining sales.

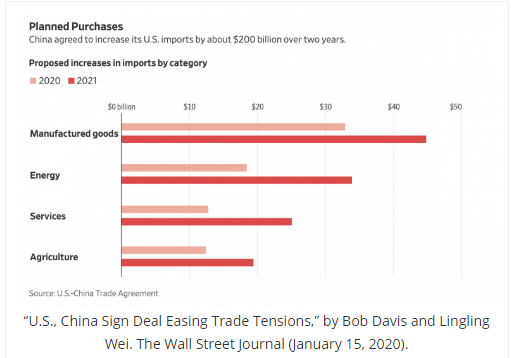

The recent signing of “phase one” of the US trade agreement with China marks a positive start to 2020, with President Trump’s deal winning high praise from the National Association of Manufacturers and other industry groups. The agreement requires the US to reduce tariffs from 15% to 7.5% on $120 billion in Chinese imports, while simultaneously putting a halt to further tariff escalations. In turn, China has committed to purchase $200 billion in American goods over the next two years, of which a significant portion are US manufactured goods.

US tariffs on about $370 billion in Chinese goods, or about three-quarters of Chinese imports to the US remain. Absent any “phase two” negotiations, manufacturers should prepare to address the increased costs of imported goods as the tariffs are expected to remain over the next two years, with many weighing the options of passing on the costs to their customers or absorbing them.

Outside of trade disputes, manufacturing output has also been hurt by a generally weak global economy. Investment in oil and gas exploration has been declining due to low oil prices, and the automotive sector is forecasting a decline in sales after several years of increasing auto purchases. Additionally, the US dollar’s strength relative to the Euro and other currencies has increased the cost of American goods abroad, stifling exports in the process.

Despite these challenges, economists are cautiously optimistic that the sector will rebound in 2020 as the trade disputes fall into some levels of normalcy and the global economy picks up steam. President Trump is also expected to sign the U.S. – Mexico – Canada agreement that will keep many goods moving across the border tariff free.

While the manufacturing sector continues to add jobs, 2018’s hiring surge was not replicated in 2019 – the sector added only 46,000 jobs in 2019 compared to 264,000 in 2018. Labor shortages are pushing many manufacturers into alternate, more costly solutions through automation and sophisticated equipment purchases requiring less workers.

Continued capital investment needs in automation and modern equipment are eased by favorable interest rates and favorable business provisions of the Tax Cuts and Jobs Act (TCJA).Companies now have the ability to deduct 100% first-year bonus depreciation for qualifying assets placed in service between September 28, 2017, and December 31, 2022. The bonus depreciation percentage will begin to phase out in 2023, dropping 20% each year for four years until it expires at the end of 2026. Business owners should plan future capital expenditures carefully and consult with their tax advisor for guidance. Each situation is conditional, and it may not always be beneficial to fully depreciate assets in the year of purchase. While the TCJA allows the deduction for federal tax purposes, many states, including Ohio, Kentucky, and Indiana, don’t conform to it.

Some manufacturing sectors are poised for growth heading into 2020. Department of Defense contractors should see an uptick in coming years as the 2020 budget totals $718 billion – the largest annual amount requested over the 5 year period from 2021 to 2024. Demand for military equipment is on the rise with a global focus on military modernization. IBISWorld’s list of the fastest growing industries in US by revenue growth for 2020 shows automated guided vehicle manufacturing grew by 48.2% from 2018 to 2019 and shows no signs of slowing. Wind turbine and solar power also make the list of fastest growing industries in the US, increasing demand for manufactured components of alternative energy sources.

Manufacturing will continue to face challenges in the new decade as companies restructure and make investments necessary to boost productivity and become more globally competitive while navigating through a new era of trade policy. It is also an exciting time for the industry as technological advances are propelling companies to new heights. With over 225 manufacturing and distribution clients, VonLehman’s specialized M&D team can position your company for growth and sustainability in the midst of volatile conditions.