Dry Powder Report

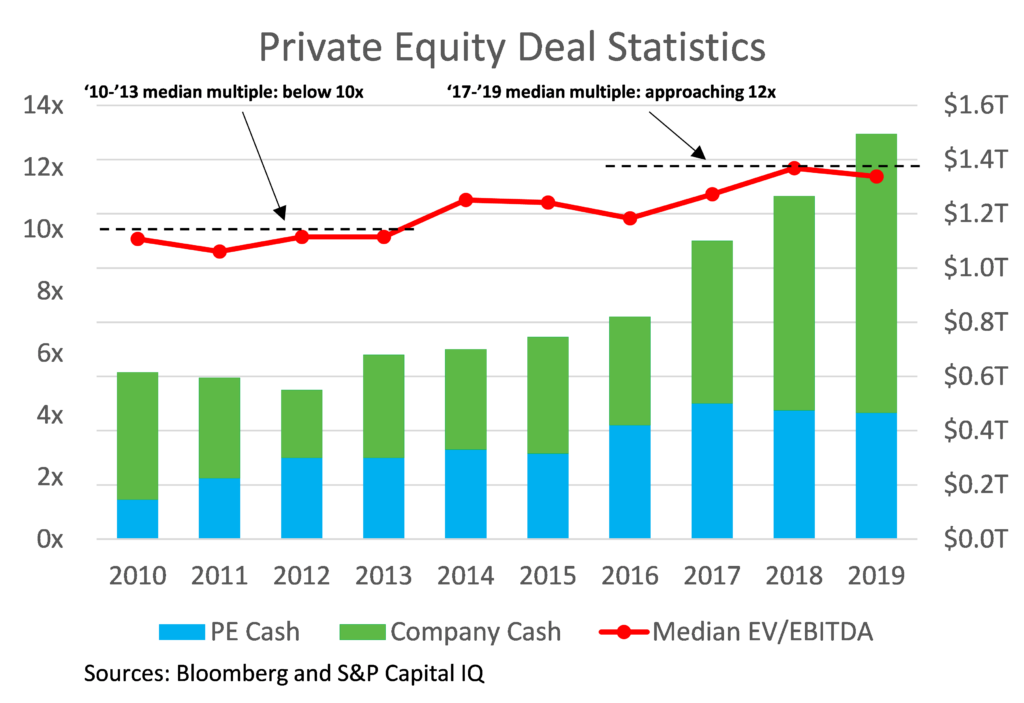

As of the start of 2020, private equity (“PE”) firms have amassed $1.5 trillion in cash mandated to be used for new acquisitions. This war chest of cash is the most abundant it has ever been and is more than double the levels that existed only a handful of years ago. During the boom years leading up to 2008, the amount of unused cash, or “dry powder,” was only $0.5 trillion; approximately a third of what it is today. This cash pile has grown significantly in the last couple of years. As illustrated in the below graph, an increased amount of cash available correlates with the valuations that businesses receive.

The primary contributors to these higher levels of cash are investors in private equity groups which include pension funds, endowments, and ultra-high net worth individuals. Recently, investors have been shifting from public stock markets to the private markets. Private equity firms have benefitted from this increased enthusiasm driven by decreased returns achieved in public markets as well as hedge funds. During the past five years, hedge funds realized an annualized return of 5.5% compared to the 14.4% returns that PE investors have been achieving in the same period.

Mergers and acquisitions (“M&A”) are traditionally discussed in terms of multiples of the total Enterprise Value (“EV”), or purchase price, divided by the amount of Earnings Before Interest, Taxes, Depreciation, and Amortization, also known as EBITDA. This “EV/EBITDA multiple” demonstrates how many “turns” or “times” of EBITDA a buyer is willing to pay for a company. For example, if a company generates $5 million of EBITDA and the EV, or purchase price, is $50 million, the implied multiple is 10x ($50/$5 = 10x). The EV reflects the current market value of a company taking into account all money that can be distributed to both shareholders and debtholders. Since EBITDA is a type of measure for profitability, the EV/EBITDA multiple shows how many years of these profits a buyer is willing to acquire to make up for the price paid, considering a certain time horizon on the investment and their perceptions of future company performance. From 2010 through 2013, the median EV/EBITDA multiple paid in PE buyouts remained below 10x. This value surpassed 11x in 2017 and has been trending toward 12x as indicated below.

So, what is causing these PE firms to continuously be paying higher prices for target companies? The two largest contributing factors are 1) low interest rates allowing firms to borrow debt at lower costs resulting in higher returns and 2) increased competition in bidding for acquisitions due to the higher levels of cash or “dry powder.” With interest rates being near record low levels, 2020 may be a productive year for deals, despite the COVID-19 pandemic. The rising level of competition among buyers creates a more challenging environment for a buyer to purchase an attractive company with lower levels of risk and higher potential growth. Regardless of the competition, private equity groups are expected to make investments and purchase companies. As a result of the growing competitive environment, PE groups are having less success at “winning” deals and becoming the buyer. When PE groups are not able to win deals and deploy cash, cash reserve levels grow, as does the pressure from investors to invest and thus new bidding wars for the most attractive companies ensue.

Why is there a need to deploy capital? All companies, both public and private, are beholden to shareholders who expect a certain rate of return on their investment. Dollars sitting in a cash account does not generate adequate returns. Additionally, private equity groups traditionally expect to ‘hold’ an investment for five to ten years before selling the company in order to earn the targeted return for their investors. The existing $1.5 trillion in cash will likely be deployed into new acquisitions within the next few years to satisfy the relevant shareholders of both public and private companies.

Contact Ely Friedman, Vice President of our M&A Advisory Team, at efriedman@vlcpa.com or 800-887-0437 with any questions regarding this article or our M&A Advisory services.