Maximizing the Child Tax Credit

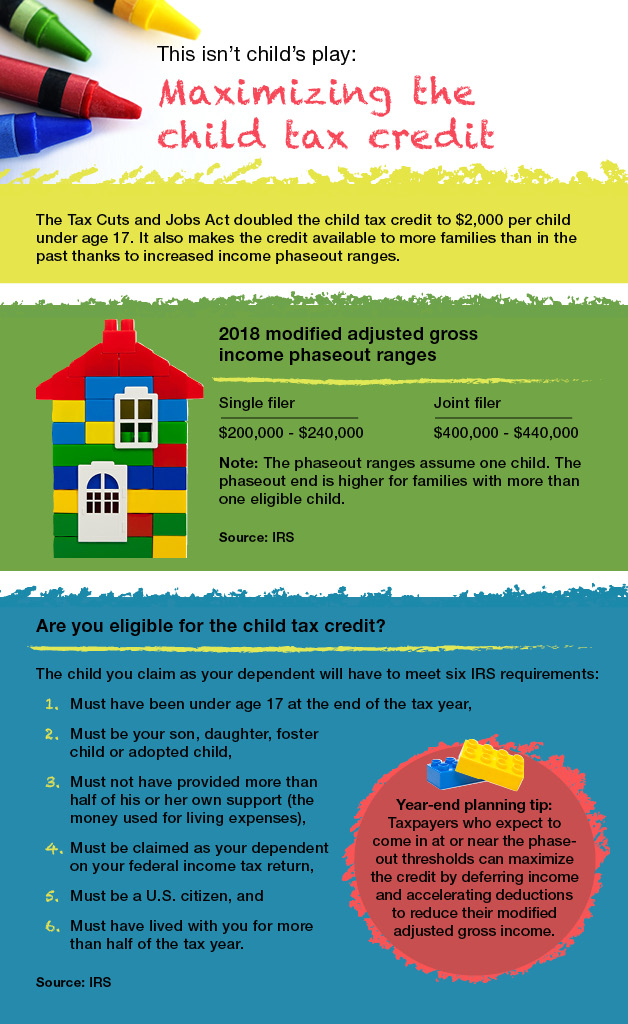

10/31/2018The Tax Cuts and Jobs Act (TCJA) doubled the child tax credit to $2,000 per child under the age of 17. It also makes the credit available to more families thanks to increased income phaseout ranges. This handy infographic breaks down the eligibility requirements and modified AGI phaseout ranges.

Contact us with any questions you may have regarding your tax situation and how you can take advantage of new opportunities.