Contributing author – Jill Kruetzkamp

On Thursday, November 2, 2017, House Republicans released a bill which, if passed, would make major changes to the current tax code impacting virtually every individual and business. The proposed plan has a long way to go before any of the provisions are passed and made effective. The Senate Finance Committee is also working on a tax reform bill. If passed into law, the majority changes in the proposed bill would not take effect until in 2018.

Some of the key elements in the bill are:

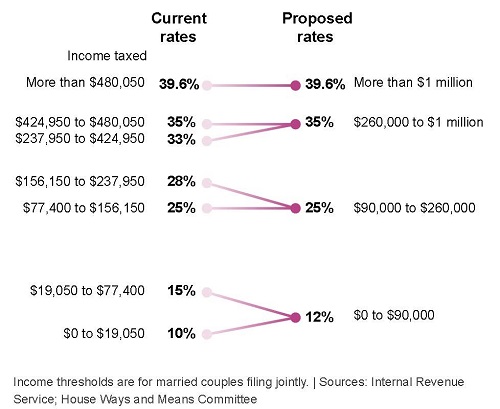

- Tax Brackets – The bill would reduce the current 7 tax brackets to 4 tax brackets. The top rate would stay the same at 39.6% but would apply to married couples with income of greater than $1 million from the current income of greater than $480,050. The chart below shows the current and proposed rates for a married couple filing joint.

- Repeal the individual Alternative Minimum Tax

- Repeal the estate tax over six years

- Double the amount of exempt inherited wealth from $5.5 million to $11 million

Standard Deduction, Personal Exemption & Child Tax Credit

Deductions

- Repeal casualty loss deduction

- Repeal alimony deduction

- Repeal student loan interest deduction

- Repeal medical expense deduction

- Repeal state and local income tax and sales taxes deduction

- Repeal Deduction for tax preparation

- State and local property taxes remain deductible up to $10,000

- Mortgage interest remains deductible with the cap on newly purchased homes decreasing from $1 million to $500,000

- Charitable contributions retained

Credits

- Adoption credit repealed

- Elderly and totally and permanently disabled credits repealed

- Mortgage credit certificates repealed

- Plug-in electric vehicles credit repealed

- Current education credits (American Opportunity, Hope and Lifetime) would be combined into one education credit. Proposed would be 100% credit on the first $2,000 and 25% of the next $2,000.

- Contributions to Coverdale education savings accounts would be prohibited. Existing Coverdale accounts can be rolled over into a 529 Plan.

Income from Pass-Through Businesses

- Create a new 25% rate for some pass-through business income – Sole proprietorships 1040 Schedule C, Partnerships 1065 K-1, and S Corporations 1120S K-1. Currently the income is being taxed at the taxpayer’s individual tax rate

- Certain Personal services businesses would not be eligible for the 25% rate: Law, accounting, health, engineering, performing arts, financial services, brokerage services and consulting

- Passive activities would be eligible for the 25% rate

- Non-passive pass-through business activities, including wages, would generally be 30% taxed at 25% and the other 70% at the taxpayer’s individual tax rate

Business Provisions

- A flat corporate rate of 20% (25% for personal service corporations), would replace the current four tier schedule (15%, 25%, 34% and 35%)

- Repeal the Corporate Alternative Minimum Tax

- Most business credits repealed except research and development and low-income housing

REPEALED CREDITS/DEDUCTIONS

- Domestic Production

- Orphan Drug Credit (testing for rare diseases)

- Corporate Charitable Contributions

- Energy Production Credit

- Energy Investment Credit

- Work Opportunity Credit

- Access for disabled Credit

- Oil and Gas Credits

- New Markets Credit

MODIFIED CREDITS

- Social Security taxes on employee tips

- Electricity from certain renewable sources

- Production from advanced nuclear power facilities

- Investment tax Credit for eligible energy property

- Qualified property, newly acquired, and placed in service can be expensed at 100% (additional year for longer life property).

- Section 179 limitation would be raised to $5 million from $500, 000 and the phase-out threshold to $20 million from $2 million

- Like-kind (Sec. 1031) exchanges limited to real estate with the exception of pending exchanges

- Net Operating Losses limited to 90% of taxable income. Indefinite carry forward and no carry back

- Recreation and entertainment expenses limited to amounts included in employees’ taxable compensation

- Cash Accounting method of accounting made available to corporations with gross receipts of $20 million or less from the current $5 Million

- Exemption for the percentage-of completion method for long term contracts would increase from $10 million to $25 million

- Several tax exempt bonds would become taxable:

- Private Activity Bonds

- Professional Sports Stadium Construction Bonds

- Advance refunding bonds

- New tax credit bonds

- Public infrastructure bonds

- Hospital Construction Bonds