Not all contributions to a charity are tax-deductible by the donor, as in the case of “quid pro quo” donations. “Quid pro quo” is the exchange of one thing for another. In relation to charitable contributions, “quid pro quo” occurs when a charity receives a payment that includes a contribution and, in return, provides the donor with goods or services valued for less than the total payment.

A common example is fundraising events. A person might donate to a charity by buying tickets to the organization’s annual gala. If the ticket purchaser gets something back in the form of a “free” dinner and entertainment, then only the amount over and above the value of the dinner and entertainment is considered a charitable contribution.

How to Acknowledge and Disclose

Quid pro quo arrangements create an obligation for the charity: if your organization receives more than $75 and provides a benefit to the donor, you must advise the donor that it’s a quid pro quo contribution. No acknowledgement is required for payments of less than $75, but many donors appreciate receiving the documentation for their personal tax return.

As mentioned before, donors can only deduct the amount in excess of the value of the goods or services they receive in return. The charity must put in writing:

- That the amount of any tax-deductible contribution is limited to the excess of the contribution over the value of the goods and services provided in return, and

- A good faith estimate of the value of the goods or services provided in return.

Written acknowledgment must be provided when the donation is solicited or when it’s received. For example, if you’re holding a charity dinner, each ticket sold should disclose the tax-deductible portion of the ticket price.

Additionally, the disclosure must be in a readily visible format — in other words, no small print. Examples can be found in IRS Publication 1771, “Charitable Contributions — Substantiation and Disclosure Requirements.”

Your organization could be penalized for failing to furnish the proper acknowledgment and disclosure. Fines are $10 per contribution, not to exceed $5,000 for a single fundraising event.

Determining the Amount of Goods and Services

An important task for the charity is to value the goods or services. The value of the goods or services should be their fair market value. The fair market value is the amount that a willing buyer would pay for the item in an “arm’s length” transaction – that is, in the marketplace. One example would be if your organization takes a group of supporters to an upscale restaurant and pays for their meals. The supporters then make large donations. Determining quid pro quo is straightforward in such cases: The amount your organization paid for the meal would be considered the fair market value, and only the amount of the contributions in excess of this value would be a tax-deductible contribution for the donor.

Your organization may have more difficulty determining the fair market value when some of the items given away have been donated to your organization. Returning to our gala dinner example, let’s assume the banquet facility charged you a reduced amount for the food as its contribution and the band performed at no cost.

To establish the fair market value to be reported to the donor, you must determine what it would cost someone to attend a similar event. In this instance, you’d need to research comparable costs at local restaurants or hotels for a dinner with entertainment, or you could ask the banquet facility and the band to provide you with the value of the food and services they provided at no cost.

Specific Application to Charity Auctions

All items auctioned at a charity auction (silent or regular) must have a value placed on them. The value should be the fair market value. Often, a charitable organization will ask the person donating the item to provide the fair market value of the item. The acknowledgement letter to the person donating the item for the auction should describe the non-cash contribution and not state any fair market value for the item.

The charity can then publish the item’s value on bid cards or in a catalog of auction items. This serves as the acknowledgment, and the buyers will be entitled to a deduction for the amount paid in excess of that value.

Reporting Exceptions

There are a few instances when quid pro quo reporting isn’t necessary:

- Token exception. This has two parts:

- The goods and/or service received is no more than 2% of the donation value or $50, whichever is less.

OR

-

- The good received is a “token item” (bookmarks, calendars, key chains, mugs, posters, tee shirts, etc.) bearing the organization’s name or logo and the donation is below a certain threshold that is adjusted yearly for inflation (the threshold is about $67 for 2023).

- Membership exception. Membership benefits other than the right to purchase tickets for college athletic events are provided (such as free admission or free parking), but the annual membership fee is $75 or less.

- Intangible religious exception. Certain religious benefits are provided by an organization operated exclusively for religious purposes (such as religious services or classes but excluding travel, education, and consumer goods).

When in doubt, unless an exception clearly applies, it is safest to report the quid pro quo transaction.

What about Form 990, Schedule G?

Fundraising events are usually reported on Schedule G, “Supplemental Information Regarding Fundraising or Gaming Activities.” If you meet the requirements to file Schedule G (currently set at $15,000 gross receipts from all events; see Form 990 Part IV, questions 17 and 18), you’ll need to maintain records of the gross receipts and expenses from each fundraising event.

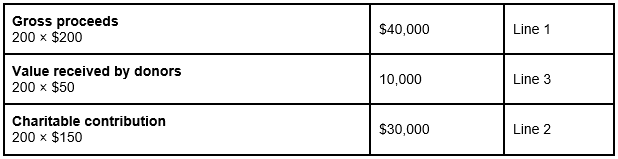

Report them on Schedule G, Part II as follows:

Line 1, gross receipts from the event,

Line 2, charitable portion of the event proceeds (the portion in excess of the value of goods and services provided to the donor), and

Line 3, gross income (line 1 less line 2).

Example: The fictitious Feed the Kids charity has a gala dinner. Tickets cost $200 (200 tickets are sold) and the value of the dinner is determined to be $50.

Proceeds should be reported as:

The fundraiser also should be reported on Part VIII of the 990: $30,000 on Line 1c and $10,000 on Line 8a.

One Last Note

Holding fundraising events is a great way to supplement your organization’s income. But you need to understand your reporting obligations if you’re providing goods or services in return. Talk to your tax advisor about your specific events and how you should disclose the details. For any questions related to this article, please contact James Alex Bramer at abramer@vlcpa.com or call 800-887-0437.