After spending significant time implementing revenue recognition and documenting your various revenue streams, you likely were hoping this monumental exercise was behind you. Unfortunately, revenue recognition is an ongoing process that should be evaluated regularly to ensure compliance with Generally Accepted Accounting Principles (GAAP). Need a refresher? We have you covered. Here are the steps you should take when evaluating your revenue streams.

- Identify the various revenue streams for your organization.

We recommend documenting the identification and stipulations of all revenue streams on a periodic basis. You should read all grant agreements or notifications and all contracts during this process. If all contracts for the revenue stream are similar in nature, these can be grouped together. However, if a revenue stream has different contracts or agreements, you’ll need to further analyze each separately. Documenting these items on a periodic basis assists in having the information readily available and saves you from having to review the agreements multiple times.

- Determine whether a contract exists.

A contract exists if the following conditions are met:

- Contract is approved by all parties involved. Approval may be written, oral, or in another form consistent with customary practices of the organization or industry.

- Each party is committed to perform the obligations outlined in the contract.

- Each party’s rights to the goods and services to be transferred can be identified in the contract.

- Payment terms can be identified in the contract.

- The contract has commercial substance (risk, timing, or amount of the organization’s cash flows must be likely to change as a result of the contract).

- It is probable that all or substantially all consideration will be collected from the customer for the goods and services promised in the contract.

If a contract doesn’t initially exist, at some point, you should consider evaluating whether it meets the qualifications identified above.

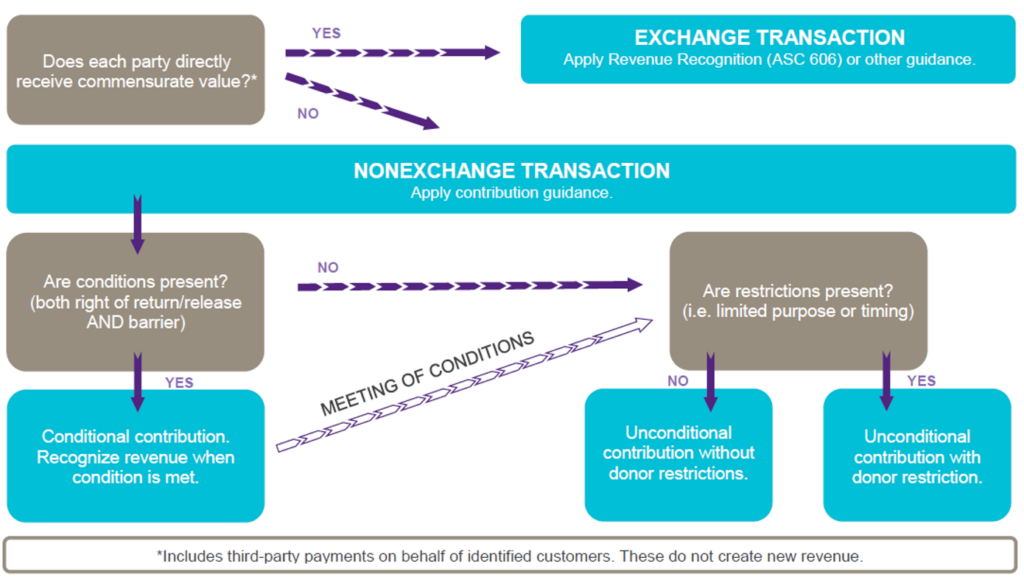

- Distinguish between a contribution and exchange transaction.

Now that you have identified your revenue streams and contracts, determine whether the revenue stems from an exchange transaction or a contribution.

Contribution: an unconditional transfer of cash or assets in a voluntary non-reciprocal transfer

Exchange transaction: a reciprocal transaction where two parties exchange something of value

Some questions to ask yourself:

- Is the cash given to the organization a payment for services or products? Are we obligated to provide something in return?

If yes, then you have an exchange transaction. If no, then you have a contribution.

- Are there both exchange and nonexchange elements to the contract or grant?

If the revenue is wholly an exchange or wholly a contribution, you’ll move forward with accounting for the contract or the contribution.

If there are elements of both, the revenue will be bifurcated into two transactions (with possible consideration of materiality). This involves identifying the value of the exchange portion and recognizing this under ASC 606. The remaining amount is considered a contribution and is recognized under ASC 958.

- For exchange transactions (ASC 606): identify the performance obligations and determine transaction prices, then recognize the revenue.

Under a single contract, there could be multiple performance obligations. For instance, a contract between an organization and a sponsor may include (1) registration for two individuals to the conference; (2) an exhibit booth at the conference; (3) advertising space in the quarterly magazine; and (4) one email promotion leading up to the conference.

For each of these performance obligations you should determine the price, which generally is determined by the stand-alone price charged by your organization for these services/products, or the estimated current market rate for similar services/products. After adding up each of these prices, you have the total transaction price, which would equal or exceed the cost of the sponsorship.

Next, allocate the relative percentage of the total price to each of these obligations and recognize revenue accordingly. If the exhibit booth represents 50% of the total transaction price, you’ll recognize 50% of the sponsorship revenue at the time the conference is held. If the cost of advertising in the quarterly magazine is 10% of the transaction price, you’d recognize 1/4th of the 10% upon issuing each of the four magazines during the year.

Revenue should only be recognized when the organization fulfills its performance obligations. This fulfillment could be at a specific point in time (i.e. the date of the event) or over time in the case of ongoing services provided (i.e. access to exclusive, member only content or on-demand trainings, etc.)

Part II – Accounting for Contributions (ASC 958)

Accounting treatment for recognizing contributions has not changed, but FASB issued a standard update to help nonprofits clarify the scope and accounting for contributions received.

Once it is determined a contract or transaction does not meet the qualifications for an exchange, a nonprofit organization should follow contribution accounting standards and determine whether the contribution is conditional or unconditional.

Conditional Contributions

Conditional contributions include both (1) a right for the donor to request the funds be returned or the ability to release the donor from their obligations, and (2) a barrier the recipient must overcome.

A barrier is a stipulation in the agreement that must be overcome (through the nonprofit’s performance or by other means) for the recipient to be entitled to the funds received or promised by the donor.

Barriers are absolute thresholds to assess whether a contribution should be recognized in the accounting records. Neither the likelihood that a barrier will be met nor the resource provider’s intent to enforce a right of return may be considered in evaluating whether an agreement is conditional. An organization will either meet the barrier (and thus, be entitled to the resources) or it will not. As such, the stipulation needs to be specific enough to allow both parties to identify the condition or conditions that must be satisfied and to be able to determine when they have been satisfied.

There are three types of barriers:

- Measurable performance barrier

Quantitative metrics that must be accomplished or specified events that must occur for a recipient to be entitled to the assets received or promised.

Example: number of individuals trained; number of meals served; specific matching funds raised by donor

- A stipulation that limits the discretion by the recipient on the conduct of the activity

The recipient has limited discretion over the manner in which an activity can be conducted. Limited discretion of the recipient is more specific than a donor-imposed restriction. Restrictions limit the use of a contribution to a specific activity or time but do not necessarily place limitations on how the activity is performed.

Example: requirement to follow specific guidelines about incurring qualifying expenses, a requirement to hire specific individuals as part of the workforce conducting the activity (such as the hiring of specified employees or an identified expert), and a specific protocol that must be adhered to.

- The stipulations are related to the purpose of the agreement (not an administrative, routine, or trivial stipulation)

Trivial stipulations, such as requiring the organization to produce a report detailing how resources were spent or requiring an audit of the organization’s financials, are not considered barriers.

Conditional contributions received before barriers are overcome should be recorded as a liability on the statement of financial position. Conditional contributions promised but not yet received are not recorded in the financials but should be disclosed in the accompanying footnotes.

It is important to note, conditional contributions can also have donor restrictions that apply once the barriers are overcome. Donor restricted contributions are discussed further below.

Unconditional Contributions

Unconditional contributions are non-reciprocal, voluntary promises, or transfers from a resource provider to a nonprofit organization that do not contain the qualifications for conditional contributions discussed above.

Unconditional contributions are further classified as restricted or unrestricted.

- Restricted Contributions

The donor specifies how or when the contribution must be used. It includes endowments restricted in perpetuity. The restriction must be more specific than the overall exempt purpose of the entity.

Restrictions on the use of contributions result from a donor’s explicit stipulation or from circumstances surrounding the donation that make clear the donor’s implicit restriction on the use of the funds. For instance, a mailer or other solicitation requesting donations to fund a project, building, etc. would imply the donor is restricting the contribution, unless explicitly stated otherwise.

- Unrestricted Contributions

The nonprofit organization has full discretion as to how and when the resources will be used.

All contributions are recorded in revenue when funds are received or promised. Donations with donor restrictions are held in net assets with donor restrictions until the restrictions are satisfied (however, simultaneous release is an option). Contributions without donor restrictions are held in net assets without donor restrictions.

Revenue recognition is a complex exercise. Your VonLehman advisor can offer guidance to ensure you are in compliance with these standards. For questions related to this article, please contact Stephanie Allgeyer (sallgeyer@vlcpa.com) or Lauren Kreutzinger (lkreutzinger@vlcpa.com) or call 800.887.0437.