While the branches of The Tax Cut and Jobs Act of 2017 (TCJA) are far reaching, one leaf you can’t afford to overlook is that of business expense reimbursables. This article offers a succinct interpretation of meal and entertainment reimbursement revisions set forth in the TCJA. A proper understanding of this update is imperative to budgeting efforts in 2018. Whether your organization is classified as small, disadvantaged, minority owned, nonprofit, or a large corporation, these rules are comprehensively enforced.

What’s Changed?

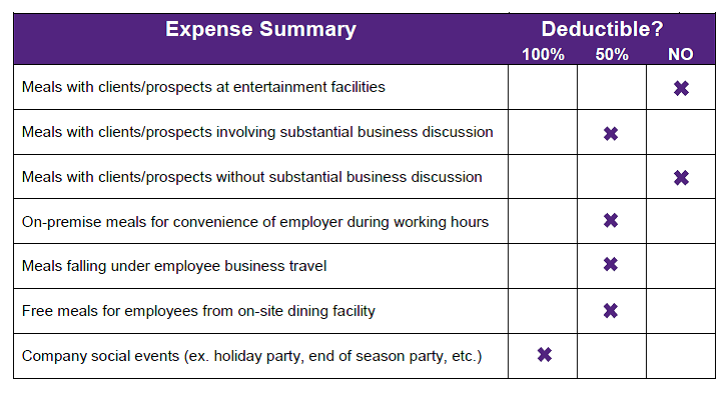

With what is perhaps the most prominent revision, entertainment expenses are now entirely nondeductible. Entertainment expenses involve any cost of admission, meals, or drinks, at an entertainment venue or event, regardless of the nature of the meeting. Previously, a business engagement at a local sports venue, involving price of admission, food, or beverages, was eligible for 50 percent deductibility. These engagements are now nondeductible. The AICPA is currently seeking clarification as to the deductibility of meals occurring before or after an entertainment event.

Business engagements at a non-entertainment venue remain 50 percent deductible, only if the engagement involves substantial business conversation. An acceptable scenario would involve the discussion of a recent proposal with a client at a local cafe. Because the deductibility is dependent on the nature of the engagement, it is imperative that the meeting’s intent/agenda is properly noted at the time the expense is submitted.

With the definition of business meal now void, it is important to note the following rules:

- Meals falling under employee travel remain 50 percent deductible.

- On-premise meals for the employer during work hours are 50 percent deductible.

- Free meals for employees from on-site dining facilities are 50 percent deductible until 1/1/26. (Meals from on-site dining facilities are non-deductible after 2025.)

Employee social events, including holiday parties or end of season celebrations, remain 100 percent deductible. Charitable events and sponsorships are now nondeductible, with the exception of any charitable contribution beyond the expense of the event itself. For example, registration for a golf outing with a cost of $200 is nondeductible, assuming the full amount is payment for the round of golf and associated food and drinks. If the cost of golf, food, and drinks, totals $100, with the remaining $100 being a charitable contribution, the contribution is eligible for a deduction. It is also important to note, organizations whose fiscal year did not end on December 31, 2017, must immediately observe these revisions, effective January 1, 2018.

Below is a quick reference guide highlighting entertainment and meal revisions resulting from The Tax Cut and Jobs Act of 2017:

VonLehman CPA & Advisory is proactive in our efforts to stay ahead of changes to this policy and we will be monitoring the TCJA closely for future clarifications issued by the IRS. If you have any questions, please contact your VonLehman advisor today.