Overview

The Coronavirus Aid, Relief, and Economic Security (CARES) Act was passed in March 2020 to provide $2.2 trillion in economic relief in response to the COVID-19 pandemic. While the bill included one-time cash payments to individuals, increased unemployment benefits, and created the Paycheck Protection Program, it also provided additional Federal funding to the Healthcare industry, state and local governments, institutions of higher education, and other organizations. As a result, organizations that have historically not been required to have a Single Audit may now be required to, under the Uniform Guidance, depending on the funding received.

A Single Audit is required under Title 2 U.S. Code of Federal Regulations Part 200, Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards (Uniform Guidance) when a non-Federal entity expends $750,000 or more of Federal awards during the entity’s fiscal year. While an entity may receive more than $750,000 in an allocation or award, the requirement is determined based on total Federal expenditures incurred during a fiscal year. Even if an entity does not meet the threshold for a single audit, they are still required to meet the compliance requirements under the Uniform Guidance.

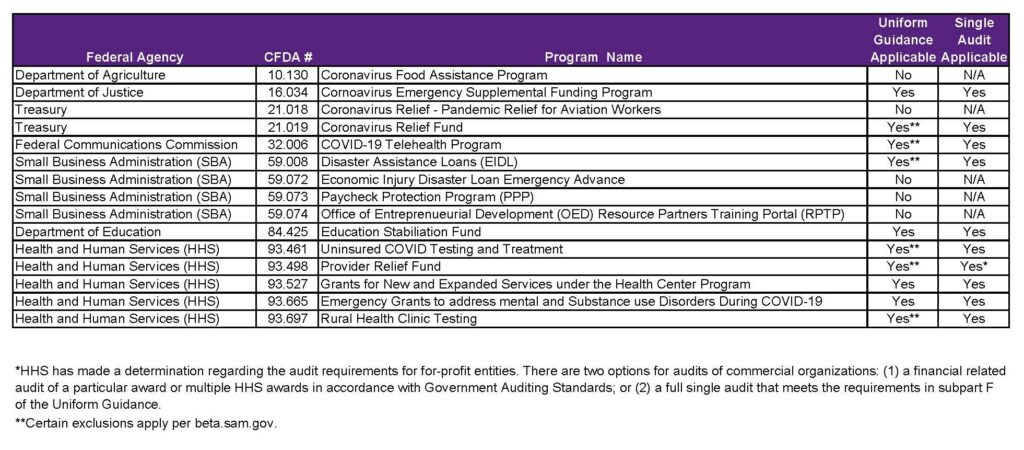

The following is summary of new COVID-19 Related Federal Programs and their applicability under the Uniform Guidance.

Uniform Guidance

The Uniform Guidance is the authoritative guidance to providing rules and regulations regarding the administration of Federal grants. It is broken down into 6 subparts and includes various appendices.

Subpart A – Contains the acronyms and definitions that are used throughout the Guidance.

Subpart B – Provides the general provisions including the purpose, applicability, effective dates, etc.

Subpart C – Includes the administrative requirements required by the Federal awarding agencies for pre-award activities as well as the contents required in the Federal awards.

Subpart D – Includes the administrative requirements for administering the award itself including internal controls, procurement, cash management, etc. This section is applicable to most recipients and subrecipients of awards.

Subpart E – Includes the cost principles for administering the awards and is applicable to recipients and subrecipients of awards.

Subpart F – Describes the audit requirements under the award including the auditor and the auditee requirements.

Whether a single audit is applicable or not, the Uniform Guidance requirements are still applicable depending on the funds awarded. Thus, it is important to understand the requirements under the Uniform Guidance.

Single Audit

Entities that meet the requirements in Subpart F of the Uniform Guidance to have a single audit (those entities that expend more than $750,000 in Federal expenditures during a fiscal year) will have an added layer to their financial statement audits or could require an audit if not required in the past. A single audit requires auditors to provide an opinion on the financial statements in accordance with U.S. GAAP and an opinion on the schedule of expenditures of Federal awards in relation to the financial statements. It also requires auditors to test internal control over compliance as well as provide an opinion on compliance over major programs tested. While an organization might not meet the requirements of a single audit in one fiscal year, it is important for the organization to understand the applicable program requirements and implement internal controls over compliance in order to be prepared when a single audit is required.

Compliance Supplement

The compliance supplement is an audit guide issued annually by the Office of Management and Budget. Federal agencies determine which compliance requirements are applicable to their awards and must be tested by the auditor. There are a total of 12 compliance requirements which follow the rules and regulations under the Uniform Guidance. However, not all 12 compliance requirements will be subject to audit. A new mandate came into effect with the 2019 compliance supplement for Federal agencies to limit compliance requirements subject to audit to six per program or cluster. Even if a compliance requirement is not subject to audit, the organization must still comply as applicable.

The 12 requirements are:

1) Activities Allowed or Unallowed (A)

2) Allowable Costs/Cost Principles (B)

3) Cash Management (C)

4) Eligibility (E)

5) Equipment & Real Property Management (F)

6) Matching, Level of Effort, Earmarking (G)

7) Period of Performance (H)

8) Procurement, Suspension, & Debarment (I)

9) Program Income (J)

10) Reporting (L)

11) Subrecipient Monitoring (M)

12) Special Tests and Provisions (N)

It is important to note that for “counting” purposes Activities Allowed or Unallowed (A) and Allowable Costs/Cost Principles (B) are considered a single compliance requirement when meeting the six per program or cluster requirement.

The 2020 Compliance Supplement will likely be issued in two parts. The first part will be the original Compliance Supplement that was developed prior to COVID-19 pandemic. It is expected to have limited information related to CARES Act funding programs, including a summary of the new programs. OMB was hoping to issue this part in late June or early July but may be later.

The second part of the Compliance Supplement will be an addendum that addresses the CARES Act funding programs. This section will likely be issued in the late summer or early fall.

As with anything COVID-19 related, the requirements for the CARES Act funding continues to be fluid. It is important for recipient organizations to be in communication with their funding agencies regarding any compliance requirements and potential audit impacts. VonLehman’s Single Audit team is continuing to monitor the daily communications and will keep you informed of any changes. If you have any questions or concerns about a possible single audit, please feel free to contact any of our experts noted below.

800.887.0437

Stephanie Allgeyer

sallgeyer@vlcpa.com