Immigration worksite enforcement surged in 2018 and shows no signs of slowing down. In 2018, the federal government announced their intentions to step up a nationwide efforts and to increase I-9 audits by the Immigration and Customs Enforcement (ICE) arm of U.S. Citizenship and Immigration Services. While you may think these actions don’t impact your organization, I-9 audits alone went up 339% from 1,360 in 2017 to 5,981 in 2018.

What is Form I-9?

The Form I-9 is a federally mandated employment eligibility verification, required to be completed by all businesses regardless of the number of employees. ICE audits look at the minute details of every field of the form to ensure it has been filled out to their exacting instructions. These guidelines are so rigid that even qualified and seasoned HR professionals can easily make errors. Independent audits should be considered to ensure compliance.

How confident are you that your I-9 forms are entirely accurate?

Let’s take a quick look at two common errors that VonLehman’s HR Consulting Group regularly encounters during client engagements to audit I-9s.

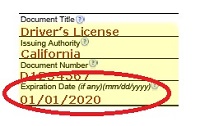

1. Did you fill out each and every date field with the dd/mm/yyyy format?

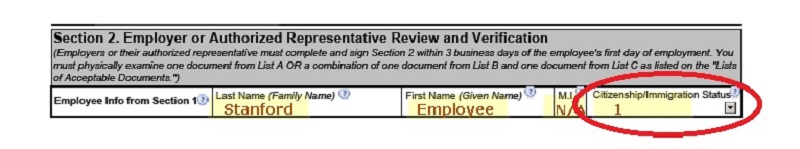

2. Did you write a 1, 2, or 3 under Citizenship/Immigration Status on page two, line one (instead of US Citizen, Permanent Resident, etc.)?

Unfortunately, these are only two of the many simple errors that are often made as a result of the complexity of the form. If identified during an ICE audit, these errors result in the issuance of fines to the respective organization. During VonLehman’s client independent I-9 audits, we often see organizations make the same mistakes time and time again, meaning each error is compounded by the number of current and former employees. Additionally, a single Form I-9 may contain many errors, each resulting in their own fine. Fines for Form I-9 non-compliance range from $220 to $2,191 per violation, with each error counting as a separate violation. Organizations that knowingly violate the law may face criminal prosecution.

To prepare for an ICE audit, and to limit potential liability, employers should take the following actions.

VonLehman recommends that employers proactively implement best practices with regard to the completion, retention and storage of their I-9 forms. With a number of changes in recent years, it is imperative that employees managing the I-9 process have a thorough understanding of the form’s requirements. It is evident that many employers have found difficulty in tracking and comprehending these changes.

Additionally, every employer should conduct regular voluntary Form I-9 self-audits. VonLehman’s HR consulting practice works with employers to conduct self-audits and corrections, generate policies and compliance plans, and build training programs, to ensure proper application of the Form I-9. If selected for an audit by ICE, the effort of hiring an independent party to conduct a thorough review and correction would prove beneficial in demonstrating you’ve made every effort to ensure full compliance.